New Online Banking

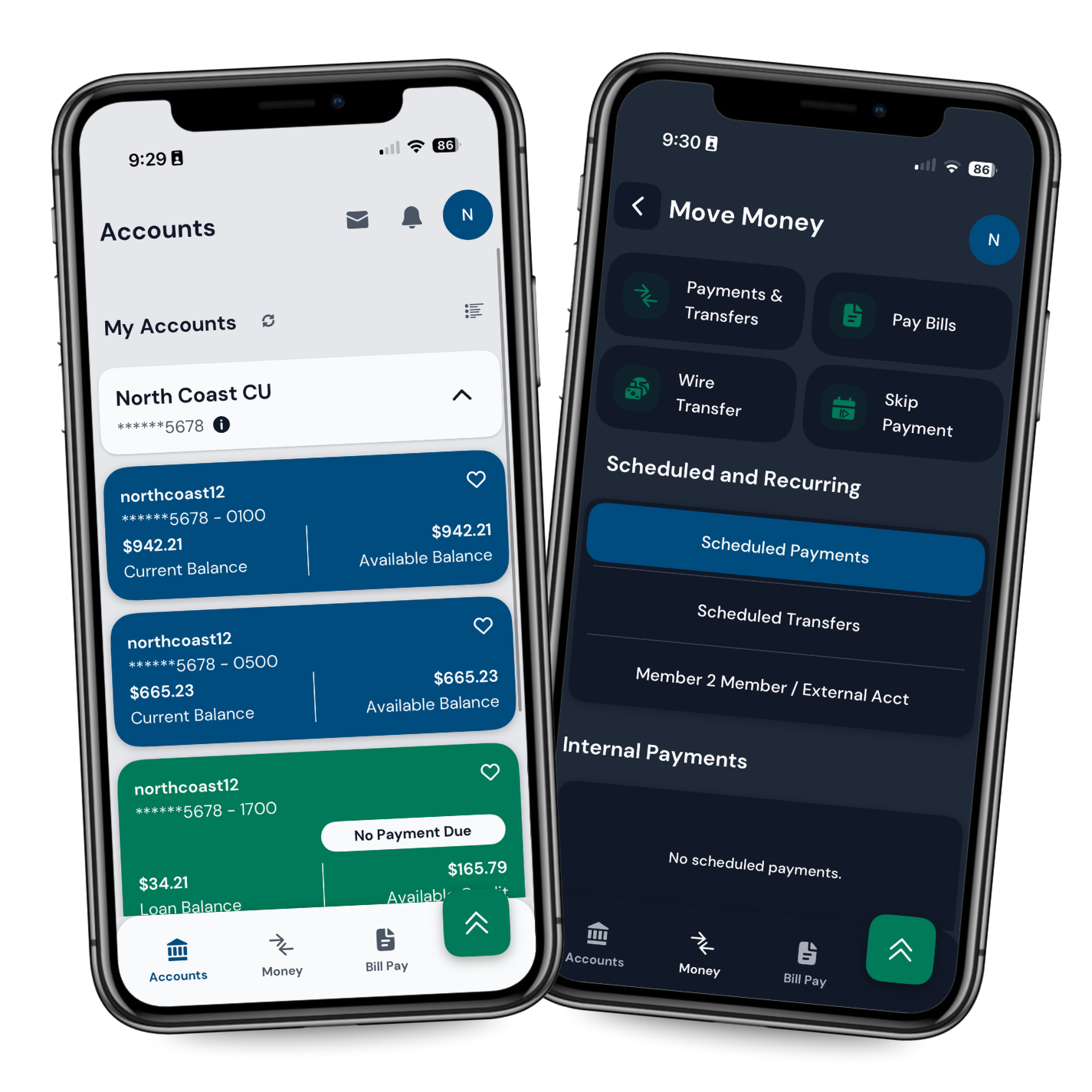

Same People. New Tools. Easier Banking.

Be in Charge of What’s Yours.

We’ve upgraded online and mobile banking to give you a faster, smarter, and simpler way to manage your money anytime, anywhere. Take control on your schedule with tools that make managing your money simple and stress-free. Personalize transactions, add memos or receipts, update your accounts, manage your cards, and set alerts. It’s all available 24/7 so you can stay in charge of your finances.

Why You’ll Love It

UPDATED FEATURES

Personalized Transactions – Add memos, upload receipts, or tag and note purchases.

Easy Wire Transfers – Submit a wire request securely using the online wire form.

Open New Accounts – Open an additional checking or savings (shares) directly online.

FRESH LOOK

Dark Mode – Reduce eye strain with a sleek new dark theme.

Language & Font Options – Choose what feels comfortable to you.

Quick Balances – View balances instantly without logging in fully.

MORE CONTROL

Card Management – Lock or unlock your card, report a card lost or damaged, or set a travel notice.

Account Updates – Update your address, phone number, and more—all online.

Custom Alerts – Get new alert options for added peace of mind.

What To Know ON October 14th and AFTER

Apple Users: When you log in, you’ll be prompted to update your app—this will install the new version, replacing the current app.

Android Users: You’ll need to uninstall the current app and download the new app from the app store.

Alerts: Our new system includes advanced alerts! Be sure to set up any alerts you previously had or explore new ones to stay in the know.

-

North Coast Credit Union is migrating to a new online and mobile banking system on October 14th, 2025. This upgrade will require that you make changes to your QuickBooks or Quicken software, so please take action to ensure a smooth transition. Conversion instructions are available below.

The conversion instructions reference two Action Dates. Please use the dates provided below:

1st Action Date: October 12th (end of day)

A data file backup and a full transaction download should be completed by this date. Please make sure to complete the final download before this date in the event any download issue after go live on October 14th.

2nd Action Date: October 14th

This is the action date for the remaining steps of the conversion instructions. You will complete the deactivate/reactivate of your online banking connection to ensure that we get your current Quicken or QuickBooks accounts set up with the new connection.

Note: Intuit aggregation services may be interrupted for up to 3-5 business days, therefore delaying this October 14th action date. The ability to download a QFX/QBO file will still be available during this outage from within Online Banking.

Quicken – click HERE

QuickBooks Desktop – click HERE

QuickBooks Online – click HERE

Please carefully review your downloaded transactions after completing the migration instructions to ensure no transactions were duplicated or missed on the register.

If you have any questions, please contact us at (800)696-8830.

Video Tutorials

Frequently Asked Questions

-

All you need is your current online banking username. If you don’t have it, click on “Forgot your username” on our current sign-in page, which will send you an email with your username.

Also, take note of any alerts you currently have so you can set them up again in the new online banking system.

-

All your payees, scheduled payments, and payment history will automatically transferred to the new system.

You will need to make sure your default checking account is correct:Login to Bill pay

Click on the Payees tab

Click edit next to the Payee you would like to change

Select the checking account from the Default pay from field

Click Submit

-

All of your external accounts and any scheduled transfers will continue to work as they do now.

-

Absolutely. You can lock or unlock your cards, report lost or damaged cards, and set travel notifications, all online or in the app.

-

Our team is here for you. Stop by a branch, call our contact center, or check your inbox for helpful guides and tips after October 14th.

-

Apple Users: When you log in, you’ll be prompted to update your app—this will install the new version, replacing the current app.

Android Users: You’ll need to uninstall the current app and download the new app from the app store.

NOTE: The old app is blue and the new app is white.